kansas automobile sales tax calculator

How to Calculate Kansas Sales Tax on a Car. The johnson kansas general sales tax rate is 65the sales tax rate is always 75 every 2021 combined rates mentioned above are the results of kansas state rate 65 the county rate 1.

Kansas Vehicle Sales Tax Fees Find The Best Car Price

How to calculate kansas sales tax on a car.

. In this example multiply 38000 by 065 to get 2470 which makes the total purchase price. The median property tax on a 20990000 house is 270771 in kansas. Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase.

Car tax as listed. Select View Sales Rates and Taxes then select city and add percentages for total sales tax rate. 635 for vehicle 50k or less.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Choose a search method VIN 10 character minimum Make-Model-Year RV Empty Weight And Year. This will be collected in the tag office if the vehicle was purchased from an individual or an out-of state car dealer.

What you need to know about titling and tagging your vehicle. Motorized Bicycle 2000. Online Calculators Financial Calculators Kansas Car Loan Calculator Kansas Auto Loan Calculator.

Or more 5225. If purchased from a kansas dealer with the intention to register the vehicle in kansas the sales tax rate charged is the combined state and local city county and. Motor vehicle titling and registration.

The minimum combined 2021 sales tax rate for kansas city kansas is. 775 for vehicle over 50000. Vehicle tax or sales tax is based on the vehicles net purchase price.

Kansas has a 65 statewide sales tax rate but also has 531 local tax jurisdictions including. Use the Kansas Department of Revenue Vehicle Property Tax Calculator to estimate vehicle property tax by makemodelyear VIN or RV weightyear for a partial or full registration year. Title and Tag Fee is 1050.

Wichita ks 67218 email sedgwick county tag office. There may be additional sales tax based on the city of purchase or residence. Kansas city vehicle sales tax calculator.

Kansas collects a 73 to 8775 state sales tax rate on the purchase of all vehicles. For the property tax use our Kansas Vehicle Property Tax Check. 425 Motor Vehicle Document Fee.

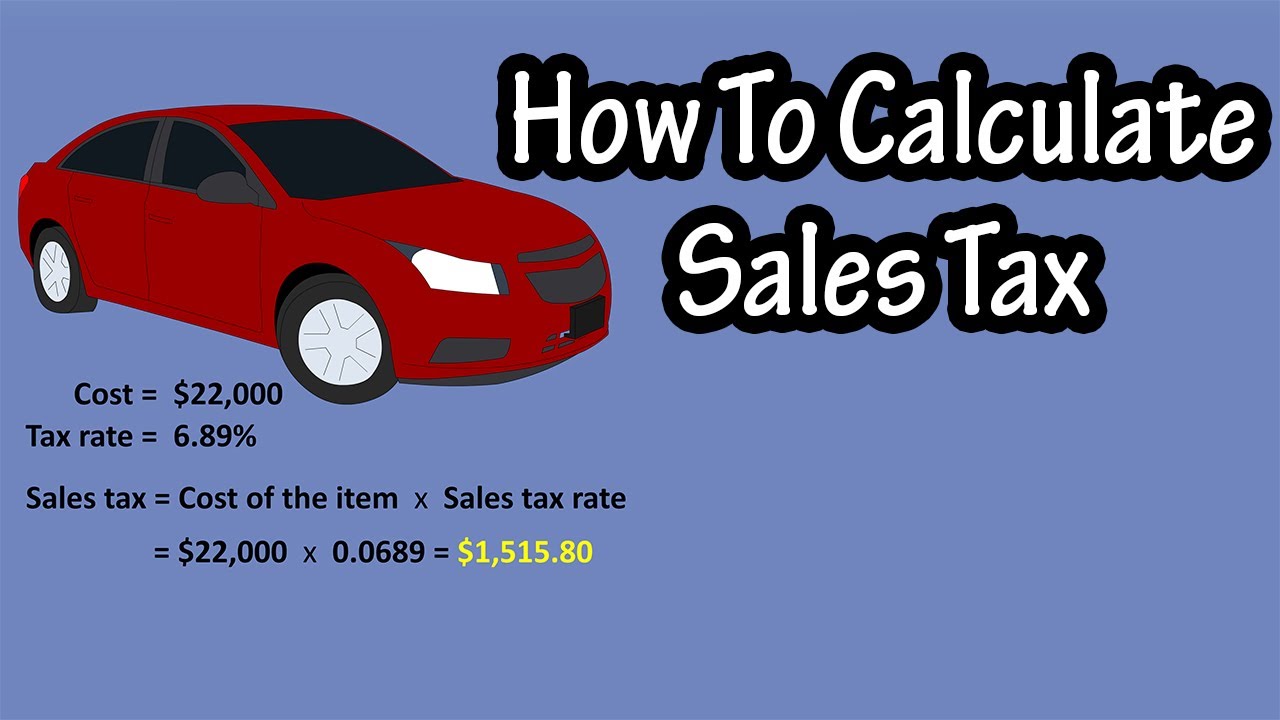

Kansas Vehicle Property Tax Check - Estimates Only Search for Vehicles by VIN -Or- Make Model Year -Or- RV Empty Weight Year Search By. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Kansas local counties cities and special taxation. Multiply the vehicle price after trade-ins andor incentives by the sales tax fee.

Modernization Fee is 400. The state sales tax rate in kansas is 650. To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county.

Car tags cost 39 or 49 while trucks weighing under 12000 pounds cost 49 to register. It should be determined by the citys sales tax fee when calculating your vehicles sales tax. 12001 and over 4400.

This page covers the most important aspects of Kansas sales tax with respects to vehicle purchases. Vehicle property tax and fee estimator. Kansas sales tax calculator by county.

DO NOT push any buttons and you will get an information operator. The sales tax in Sedgwick County is 75 percent InterestPayment Calculator. 111 s cherry st olathe ks 66061.

If you have any questions about how Kansas sales and use tax laws apply to your business please visit the departments Policy Information Library on our web site wwwksrevenuegov or call the departments Taxpayer Assistance Center at 1-785-368-8222. Home motor vehicle sales tax calculator. The vehicle identification number VIN.

For vehicles that are being rented or leased see see taxation of leases and rentals. The Tax Calculator is not intended to serve as an online. For the sales tax use our Sales Tax Rate Lookup.

1 Manufacturers rebates are now subject to tax. There are also local taxes up to 1 which will vary depending on region. Tax for all products sold in missouri.

The minimum combined 2021 sales tax rate for johnson county kansas is 948. When using the Property Tax Check keep in mind that our office will pro-rate your property tax from your. Price of Car Sales Tax Rate.

The county sales tax rate is 1. The Kansas Department of Revenue offers this Tax Calculator as a public service to provide payers of Kansas income tax with information to estimate their overall annual Kansas income tax liability. You can use our kansas sales tax calculator to look up sales tax rates in kansas by address zip code.

Or less 4225. This will be collected in the tag office if the vehicle was. The sales tax rate varies by county.

Kansas collects a 73 to 8775 state sales tax rate on. If you have any questions about how Kansas sales and use tax laws apply to your business please visit the departments Policy Information Library on our web site wwwksrevenuegov or call the departments Taxpayer Assistance Center at 1-785-368-8222. Kansas collects a 73 to 8775 state sales tax rate on the purchase of all vehicles.

You can use our Kansas Sales Tax Calculator to look up sales tax rates in Kansas by address zip code. For additional information click on the links below. The date that you purchased or plan to purchase the vehicle.

Vehicle property tax is due annually. You will pay property tax when you initially register a vehicle and each year when you renew your vehicle registration. You cannot register renew or title your vehicle s at the Treasurers office located in the.

Use this online tool from the Kansas Department of Revenue to help calculate the amount of property tax you will owe on your vehicle. This will start with a recording. You pay property tax when you initially title and register a vehicle and each year when you renew your vehicle tags and registration.

The make model and year of your vehicle. There are also local taxes up to 1 which will vary depending on region. The information you may need to enter into the tax and tag calculators may include.

The date the vehicle entered or will enter the state you plan to register it in. The minimum is 65. The median property tax on a 20990000 house is 220395 in the united states.

For your property tax amount use our Motor Vehicle Property Tax Estimator or call 316 660-9000. The median property tax on a 20990000 house is 220395 in the united states. For lookup by zip code only click here.

The Tax Calculator should only be used to estimate an individuals tax liability. The state general sales tax.

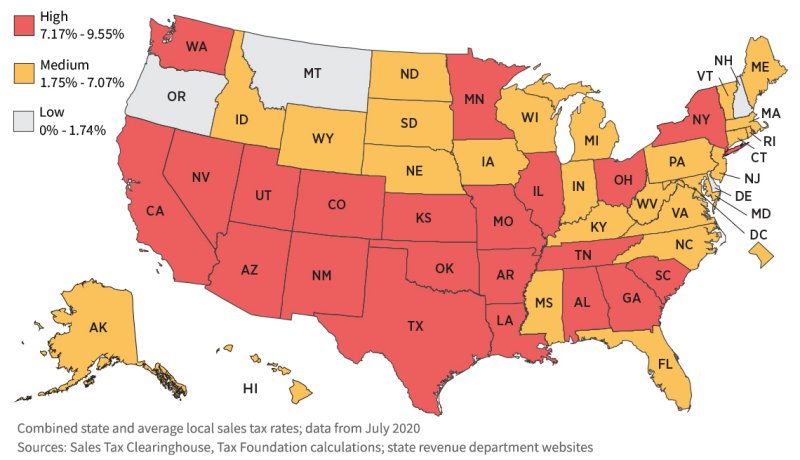

States With Highest And Lowest Sales Tax Rates

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Sales Tax On Cars And Vehicles In Kansas

Kansas Vehicle Sales Tax Fees Find The Best Car Price

Calculate Auto Registration Fees And Property Taxes Geary County Ks

How To Calculate Sales Tax How To Find Out How Much Sales Tax Sales Tax Calculation Youtube

Kia Tax Season Car Sales In Kansas City Area

Car Sales Tax In New York Getjerry Com

Dmv Fees By State Usa Manual Car Registration Calculator

Nebraska Sales Tax Small Business Guide Truic

What S The Car Sales Tax In Each State Find The Best Car Price

Kansas Vehicle Sales Tax Fees Find The Best Car Price

Auto Loan Calculator With Tax Calculate By State With Trade

Real Estate And Personal Property Tax Unified Government Of Wyandotte County And Kansas City

Missouri Car Sales Tax Calculator

Calculate Auto Registration Fees And Property Taxes Geary County Ks

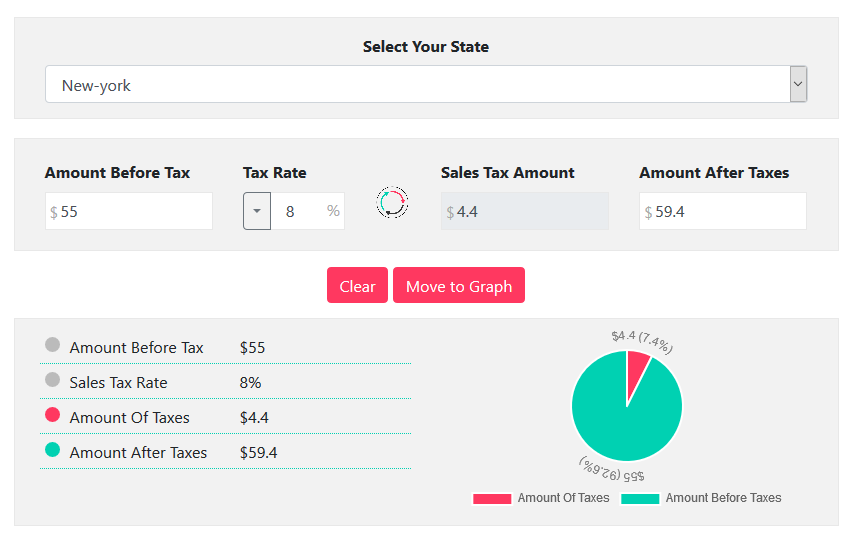

New York Sales Tax Calculator Reverse Sales Dremployee

Motor Vehicle Fees And Payment Options Johnson County Kansas